Recently, about a month ago I decided to open up an account at ING’s sharebuilder.com I had been curious about those online trading companies for some time now particularly because it seemed like the barriers to entry in terms of investing in stocks was lifted.

After looking into some of them I still had not invested because the ones that I looked into needed a minimum investment of $500 or more. That may be a small amount to many, but for me however, it was still quite a bit. Especially since I’d rather keep the small amount of savings I had/have liquid in case of any emergency or needed expense. I don’t quite live check to check but there isn’t much room for saving.

Okay, anyway I found myself being able to open an account at ING’s Sharebuilder.Below are the reasons why and my review of it.

1.) There are no minimum investments

2.) You can purchase any amount of stock you want or even fractions of a stock.

3.) Money that you transfer into your account that does not get allocated into a stock purchase goes into a money market account. Not bad considering many banks still require a minimum to open a money market account and enjoy the higher interest rates.

So those are the reasons and here is how it works and what I recommend if you decide to use Sharebuilder from ING.

First, there are several options when opening an account. One, there is an option with no monthly fee and with $4.00 trades or a $12.00 recurring monthly fee with up to six trades with the 7th or greater trades being at $4.00 By trades, Sharebuilder means purchasing.

There is also a schedule to buying and purchasing if you want the $4.00 trade to apply. If you want to purchase stock in real time or ASAP outside of your schedule it costs $9.95. Other small fees may apply with certain types of transactions. I can’t recall.

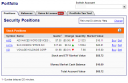

So this is the screenshot of when my money was transferred to INGs sharebuilder. This usually takes about a day or two.

I placed $80 in my account but only decided to invest $70.00 in stock. At the time I was not quite clear if the remaining balance went to the money market account or if it sat there until you opened the money market account. The former is true.

As you can see in the calendar next to the chart, the purple square indicates when sharebuilder will make the orders and the red indicates when the orders will be purchased at their market value.

If I remember correctly, there are 4 different schedules you can set up in terms of investing. The one time schedule, what I did here, will occur at the last Tuesday of every month. There is also a montly recurring schedule, a bi-weekly recurring schedule and weekly schedule. The last three schedule options will automatically withdraw from your account and invest it in the designated stocks or place it in your money market.

For each different company you purchase stock from, you will be charged $4.00 if you go with the fee-less type account.

For example, I decided to invest $20, $30 and $20 in AMD, JAVA (Sun Microsystems) and Vonage respectively. Having placed $80.00 in my account, my net investment after fees should be $68.00 ($10 in the money market $58 in stocks) plus or minus gains or losses. The $58.00 comes from the $70.00 investment minues the $12.00 fee for purchasing stok in the three companies.

You probably noticed that I have fractions of stock in there. Well in a way that is convenient because you can treat this like your mutual fund, but when it comes time to sell, it may not be feasible to get those fractional stocks sold. Also, when you decide to sell, that will cost you $9.95. Buying or selling real time costs just that.

As I mentioned you can create a schedule for your investments. Here is a screenshot of that.

There are also other features you can take advantage of with Sharebuilder. Some include trading stock options and investing in the money market accounts.

You can also research your stocks, that is view stock charts and other nifty data regarding the company you are planning to invest in.

Paid optional features include a portfolio tax tool and gans and losses portfolio viewer.

Personally, I would not pay for these since you can probably accomplish what the gains and losses tool does for you for free via finance.google.com.

You can enter what you paid for the stocks and even fractional amounts of the stocks purchased and it will track you gains and losses. Here are mine at the time of writing this.

You may even be able to create an API for this and have it showing real time on your website or your iGoogle account. In addition, I would rather login to my google account versus my sharebuilder account on a public or friend’s computer to check my investment status.

My recommendations:

1.) Do not upgrade to the tax tools or profit and losses tools. Sharebuilder will likely have to send you a 1099 at years end anyway for your taxes.

2.) Use Google finance or any other comparable tool to track your gains and losses. Embed any available APIs in your website if you are able to.

3.) Before purchasing stock accumulate a good chunk of cash in your money market account. Think about it, even at $4.00 per purchase, you will pay 10% if you only invest $40.00. It is likely going to take you more than a year to see that money back. So Accumulate a good sum so that you can have a good return on investment and not one that is trying to catch up with the fees you paid. You can have the recurring schedule, just transfer it to your money market account so that it can accumulate.

4.) If you want to create your own mini fund but don’t know where to start, you can always look at what other funds are investing in. In my opinion State Farm has good knowledge about investing and their funds do well. You can go to their site, look at the prospectus of one of their funds and place their some or all of their top 10 companies of their fund in your portfolio. Maybe that’s not being too creative but it’s an option.

In regards to choosing stock, well I didn’t do any reaserch and in fact two out of the three companies I chose are considered bearish, meaning dormant or not likely to perform well. So far, that has been true of AMD. Vonage is the other one but I have faith in Vonage, mainly because I love their product (IP Phone). Java, I wasn’t too sure of when I made my initial investment but I know that many fine programs are developed in Java, such as data mining and anylitical software. Eventhough Microsoft is as popular as it is, I don’t think these software manufacturers will be switching to a different programming language.

Hope this helps. If you have questions or something is unclear, post and I will reply. =) Hope you found this post helpful.

I have been with Sharebuilder for some time. I have always used the basic plan, and I have been quite happy with it. I think that you produced a good description of what is going on in this investment plan.

Hi there!

You said, “You probably noticed that I have fractions of stock in there. Well in a way that is convenient because you can treat this like your mutual fund, but when it comes time to sell, it may not be feasible to get those fractional stocks sold.”

Why would it not be feasible? Is there a compromise? Are you saying that it might be categorically unsellable in a given time period just because it’s fractional? Can I just round it down to the nearest integer and sell that quantity immediately?

I think the only part that may be un-sellable (or difficult to sell at least) would be the fractional stock. But there is no problem selling whole shares. So to the question, “Can one round down and sell the quantity to the nearest integer?” the answer is “Yes”.

“In my opinion State Farm has good knowledge about investing and their funds do well. You can go to their site, look at the prospectus of one of their funds and place their some or all of their top 10 companies of their fund in your portfolio.”

—

I use sharebuilder to purchase ETF’s and it works for me. Regarding your quote above: why not just buy that mutual fund or a similar one? You can open an account at fidelity or vanguard and purchase the fund without a brokerage fee (don’t exist on mutual funds) and no load (sales fee). This would be to your advantage because an investment of $40 would buy a full $40 worth of shares in the fund.

Sharebuilder offers mutual funds as well, although a limited selection with high minimums and high expense ratios

I am a soon to be ex-customer of Sharebuilder. Like all brokerage firms, this one is not too bright.

First, they will bait and switch on plans and rates. My no fee IRA account that I traded vigorously was charged a fee of $25 five months after opening even though I had racked 3-4 times that in trading commissions. Of course, my money sailed out of the account after that stunt.

Second, I traded my “basic” account fast and furiously in the volatile AIG market… or at least that is what I attempted to do on September 16. It was then I found out how flaky Sharebuilder’s systems really are.

For example, Sharebuilder has a bunch of inane rules that prevent entry of a limit orders. These rules are triggered by a stock price quote that is delayed 15 minutes. Try that with the price volatility of AIG. The result was that I had to manually babysit my positions and pray that the 15 minute delayed price would not complicate entering or exiting positions in a really stressful market. Though “fast” markets are rare events, when they occur it is important to have prompt, uncomplicated order execution. That is clearly not Sharebuilder!

Thus I have concluded that Sharebuilder is both stupid to its “good” customers and dangerous to all in a fast market. Sharebuilder cannot handle real trading, and I guess their niche is the nickle and dime trader who is not too picky about, you know, “price”. Caveat emptor

Thanks for sharing your experiences, great detailed descriptions and very informative.

Can anybody tell me if the recent turmoil in the banking industry what effect would a bankruptcy of ING have on my Sharebuilder account? Would I lose access to my money?

Thanks

I myself started a Sharebuilder account solely on the fact that I can open an account with less startup money. $500.00 is a lot to most of us so the choices are limited.

With Sharebuilder you have a huge delay on quotes and trade execution so if you want to be a ‘trader’ forget it. You will lose your shirt if you try to execute quick trades here. I use the free version myself because i’m cheap but more services and options cost money and that money could be used to buy stock so…..what do you do?

You use Sharebuilder as a way to increase your investment dollars while still being in the market. When I get my Sharebuilder account to $500 I will move it to another online account, yet to be determined.

I am really upset with sharebuilder. I am deployed with the miltary in Iraq. I’ve have been buying and selling stocks for 1 year now. When I tried to enter sharebuilder a few days ago my access was denied. I tried everything. I called ING and the customer service rep told me since I am now in Iraq I am not allowed to access my account. I have no access to my stocks or my money market account. They told me that any computers showing a out of USA IP address is blocked from access to any Sharebuilder sites. So now I have thousands of dollars I have no access too. Waiting for my next R&R to return to the USA and the first thing I will do is get on a computer and remove my direct deposit checking, savings and Stock accounts from ING.

D. Smith,

See if you can mask your IP address as a USA IP using proxy servers. That may help you administer your investment until you’re able to reach the states and do what’s necessary. Good luck.

Opened a sharebuilder account and got killed in early trading when website went down right after opening. terrible service. couldn’t even do over phone stops. that service overloaded too. for my money if you can’t handle the volume you are not easy investing. find another site to use this one is not what it is advertised to be.

Sharebuilder sucks! Used 2 months and now moved and now transferring assets to Scottrade

1. Many times trading page was not loading and was end up with some xml error result.

2. Unable to reach by phone when site is down

3. Highest trading fee. Not worth for short selling

4. Execution is not fast and may change price if not using limit.

Advantage:

Next day in/out money transfer

1. Sharebuilder’s communications are fuzzy… not to the point.

2. Fees have deep fine prints.

3. The price on the site are not real time

4. Once you place an instant trade ( $9 a pop for less than 1000) you have no way to know when they will finalize it so no way to know what price you were able to get.

Pure S**t service !!

I have been with sharebuilder for years now. i was set up with them thru Wells Fargo who shortly after I singed up DROPPED sharebuilder. This should have been a warning sign. In June I opened a ING account and then a few weeks ago I opened an account for my 14 month old daughter. WHAT a nightmare the whole thing has been I purchased a LOT of Citi stock through share builder. It took way too long to execute the trade so i paid TOO much. then I went to sell last Thursday. OMG friggin nightmare took 4 hours to get online to sell. Trade by phone hold times were announced as 45 minutes. 2 hours of holding and no one ever came to the phone. I finally got online and sold. I lost thousands no kidding thousands as I sold for 3.13 instead of 3.85. It is OK I sold and did OK. Now is where the fun starts. The trade settled on Monday. I am trying to get share builder to transfer my money to me. they WILL NOT WIRE IT. THEY WILL NOT SEND IT TO UNION BANK (which has been verified by them with deposits) They say i need to have Union Bank MAIL them a letter stating that it is my account. I really don’t get it. They said to request a withdrawl yesterday put in ANY bank I wanted it to go to. I did using yet another VERIFIED bank. it was denied saying that the money did not come from that bank. (It did) So today they told me to transfer it back to ing and withdrawl it from there. We will see on Friday if I get my money or not. Anyone know are they in trouble? Did they take tarp money? I have talked to Joe emp ID 7778 HE IS A LIAR straight up. i ahve talked to Dan emp id 7854 HE PLAYS GAMES says the only way to withdrawl is thru ing then says wait let me see if I can do anything else. (I think he was just a freak) then i spoke to Christioe emp id 702101 with ing. She assures me i will have my money Friday…..welll maybe Monday….again another stellar employee. I can not wait to get my money not sure if I will or not at this point. If and when I do you can bet I will let anyone know what a piece of shit these two companies are. BTW when I started saving with them in June 2008 they were paying 3% today it is 1.5% OK .5% more than my local bank however at least with my local bank I can get my money back. Good luck with them if they are your choice……

ING Sharebuilder got me, too. I lost thousands on a DRYS stock transaction where they sold way way below my stop-loss order and then trying to get ING Sharebuilder to transfer my cash out to another brokerage took 2 full weeks. 14 days through accounts that had been verified previously while the stock market was going through the roof, day after day!!! That’s freakin’ ridiculous. It was supposed to take 4 business days. I lost sooooo much money, I hate Sharebuilder. I wish I had never heard of them. I have accounts with both etrade and Wellstrade, now. I am still trying to transfer out the stocks I have left in Sharebuilder, but I think it’s going to take months. I am thinking I can reduce this to only 3 weeks, if I sell everything now at more of a huge loss (transferring the cash out as before) when I really just want to hold on to the stock and just transfer the certificates to another brokerage. How many months is this going to take ???? Screw Sharebuilder, I hate them.

Pingback: How to Choose an Online Broker and Invest Online | Business Pundit

I saw that ad saying “$4 trades” and fell for it. You don’t find out till you open an account that it’s really $9.95. That’s pure deception. I opened my account in Feb. 2009 and Sharebuilder closed my account in May 2009 and kept the money I had realized in my account. They’re still asking for documents.

I reported this to the SEC and FTC.

My account was worth about $1600 and they returned $700.

They have the worst Customer Care I’ve ever seen.

I’m waiting to see what the outcome will be. I have consulted a Securities Attorney and am contacting the State Attorney General in Florida, NC, and Washington State.

Roger L. Russell

hey man thanks for posting this.. it’s very helpful

I had a bad experiance where they took 14 minutes to process a transaction. I did not have a lot of shares, so the money factor was not a big deal. (It went up $3 a share in that time period) It was the customer service that bothered me. I am going to migrate my account when I find a company that will pay for the transfer.

Additionally, there a lot of stocks that are unavailable through ShareBuilder.

Just thought I should share that. Thanks.

Sweet review. and relevant 2 years later. I’m strongly considering opening a sharebuilder account and now I have the impetus to do it so thanks!

Well I am glad i read the reviews! Not going to open a sharebuilder account.

I’m frustrated with ShareBuilder now.

I can get money into my account and perform trades, but do anything like sell to move the funds back to savings is nearly impossible. I’ve been trying for over 2 weeks and all I get is bunch of error messages. Even when trying to send a simple email contact form.

For the actual trades themselves, while Sharebuilder is slow about it, taking a business day or two, getting them setup to be done is pretty painless.

I’m getting charged fees though on no load mutual funds for transactions when the trades were going in as free trades.

At this point, I can’t recommend Sharebuilder and if I could get my money out in a timely manner would go back to USAA for trading.

I hope Sharebuilder sees this as I’d like to be happy, positive experience customer for them, but I can’t even get a hold of them. Ah, the fun of living overseas out of normal US business hours.

Michael

Hey guys, thanks for your comments, i was going to open an account, but i’ve changed my mind. Good luck for those having trouble getting back their money, keep fighting..

I just opened a Sharebuilder acct a few weeks ago and I love it. The fees appear to have gone down in price since some of these older comments. Now its $4/ trade for automatic investments. If you pay the $12/ month for the advantage plan you get 12 free trades. So that works out to $1/ trade if you do 12 trades. Any trade after that is also $1.

Instant trades are different. Those are around 7.95 for the advantage plan and 9.95 for the basic plan. The bottom line is day traders will probably hate this site but people that are buy and hold or just want to contribute every few weeks (dollar cost averaging) buying partial shares, this is a great site.

Also I have an Orange savings account from ING and can instantly fund my stock accounts for free from that acct.

I “thought” I was just researching and apparently opened an account with ING. I immediately asked that it be closed as it was a mistake on my behalf. I cannot sign back into the account I created because I have no idea what password I created. I cannot get a new password because they say I must have entered the wrong date of birth. They then proceeded to take money from my bank account every month. I emailed, called and spent endless time explaining over and over again my situation to everyone but had no success. Then they said I would have to fax them a copy of my State ID. I did as they asked but still no resolution. I was then informed this was not enough even though I verified my date of birth my SS#, my address etc. No, now they say I have to complete two notarized forms and send them in so I can close out an accout which I didn’t know I’d created in the first place. I have had to change my Visa card with my regular bank to stop them taking money from my account. I am now into the 3rd month of paying heavily for my mistake?? Silly me filled in information on an internet form because I thought I was getting an evaluation based on my information when what I was getting was a new account! Their customer services is horrible and I believe they are theives – I doubt I will get a single penny back of the money they have STOLEN from my bank account because they now say the shares I purchased will have to be sold??? DO NOT OPEN OR ATTEMPT TO INQUIRE ABOUT AN ACCOUNT WITH THIS COMPANY!

An awful experience indeed. Thank you for taking the time to share and write about it

Pingback: How to Choose an Online Broker and Invest Online - OneClick

Pingback: How to Choose an Online Broker and Invest Online - freehighdabacklink.com